Corporate Governance

We are building relationships of trust with our stakeholdersRecognizing the importance of management as a company having social responsibilities, Socionext has positioned the development of organizational structures and mechanisms to ensure transparency and fairness in decision making and the building of a trust relationship with all stakeholders, including shareholders, as one of its most important management issues. Accordingly, we aim to increase our corporate value and achieve sustainable growth through the implementation and continuous improvement of the Corporate Governance Code.

Corporate Governance Report

Please see the report below for the status of Socionext's corporate governance.

Reasons for Adoption of Current Corporate Governance System

To increase corporate value over the medium to long term, the Company has established a corporate governance system based on a company with an audit and supervisory committee.

●Directors

| Number of Directors Stipulated in Articles of Incorporation | Up to 10 (No more than 3 directors shall be Audit and Supervisory Committee Members.) |

|---|---|

| Directors' Term of Office Stipulated in Articles of Incorporation | Director (Excluding directors who are Audit and Supervisory Committee Members.): 1 year. Director who is an Audit and Supervisory Committee Member: 2 years |

| Chairperson of the Board | Chairman |

| Number of Directors | 9 (Of these, 3 directors are Audit and Supervisory Committee Members.) |

| Number of Outside Directors | 6 |

| Number of Independent Directors among Outside Directors | 6 |

| Lead Independent Outside Director | 1 |

(1)Strengthening Supervisory Functions

The Board of Directors, which includes Independent Outside Directors, and the Audit & Supervisory Committee, the majority of whose members are independent outside directors, will strengthen the supervisory function over business execution.

(2)Ensuring Management Transparency

The Company ensures management transparency by appointing more than one-third of its directors as independent outside directors and by having the Nomination and Compensation Committee, a majority of whose members are independent outside directors, report to the Board of Directors on the nomination and compensation of officers.

(3)Acceleration of Decision-making

The Board of Directors focuses on guiding the course of action for management, making important decisions and overseeing the execution of business operations. By delegating its executive authority to the CEO and executive officers, we aim to promote business operations and increase corporate value through accelerated decision-making.

Status of Directors

The status of the Company's directors is as follows.

| Position in the company | Name | Responsibilities and significant concurrent positions |

Term of office as Director |

own Number of shares of the Company*1 |

|---|---|---|---|---|

| Representative Director, Chairman and CEO | Masahiro Koezuka | 10years and 9months |

122,099 shares | |

| Representative Director, President and COO | Hisato Yoshida | Global Leading Group (GLG) Co-Lead | 2years | 20,962 shares |

| Director, EVP and CFO | Yutaka Yoneyama | In charge of CSR (Sustainability) In charge of risk management |

3years and 3months |

20,962 shares |

| Lead Independent Outside Director | Masatoshi Suzuki | Former Representative Director, President, MIRAIT Holdings Corporation (currently MIRAIT ONE Corporation) | 4years | - |

| Independent Outside Director | Sachiko Kasano | Attorney-at-law at Shiomizaka Sogo Law Office Outside Director (Audit and Supervisory Committee Member)of Restar Corporation Outside Statutory Auditor of PRAP Japan, Inc. | 3years and 3months |

- |

| Independent Outside Director | Kazuhiro Nishihata | Senior Executive Vice President and Representative Director of NTT DATA President and Chief Executive Officer, Representative Director of NTT DATA, Inc. |

Newly assigned | - |

| Independent Outside Director (Chairman of Audit & Supervisory Committee) | Yasuyoshi Ichikawa | Member of Yasuyoshi Ichikawa Certified Public Accountant Office, Certified Public Accountant Outside Statutory Auditors of Dai Nippon Printing Co., Ltd. | 3years 3months |

- |

| Independent Outside Director (Full-time Audit & Supervisory Committee Member) | Morimasa Ikemoto | Former Full-time Corporate Auditor, FUJITSU COMPONENT LIMITED (currently FCL COMPONENTS LIMITED) | 2years*2 | - |

| Independent Outside Director (Audit & Supervisory Committee Member) | Noriko Yoneda | Representative Attorney, Kobe Grace Law Office Outside Director of KEIWA Incorporated |

2years | - |

Views on Diversity of the Board of Directors

The Company discloses a skill matrix that lists each director's knowledge, experience, and abilities, as well as a combination of the director's skills etc. in a manner appropriate to the business environment and business characteristics, along with policies and procedures for the election of directors. Candidates for Directors who are not Audit & Supervisory Committee Members are determined by the Board of Directors based on a report by the Nomination and Compensation Committee, the majority of whose members are Independent Outside Directors.

Candidates for Directors who are Audit & Supervisory Committee Members are determined by the Board of Directors, with the consent of the Audit & Supervisory Committee, based on a report by the Nomination and Compensation Committee, the majority of whose members are Independent Outside Directors.

Skill matrix of Directors

The skills matrix for the directors is as follows:

| Name | 1 | 2 | 3 | 4 | 5 | 6 | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| Gender | Outside | Independent | Audit & Supervisory Committee Member |

Management experience at listed companies |

Global corporate management |

Semiconductor business |

International (Overseas experience) |

Finance and Accounting |

Legal and Compliance |

|

| Masahiro Koezuka | Male | ✓ | ✓ | ✓ | ||||||

| Hisato Yoshida | Male | ✓ | ||||||||

| Yutaka Yoneyama | Male | ✓ | ✓ | ✓ | ✓ | |||||

| Masatoshi Suzuki | Male | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Sachiko Kasano | Female | ✓ | ✓ | ✓ | ||||||

| Kazuhiro Nishihata | Male | ✓ | ✓ | ✓ | ✓ | ✓ | ||||

| Yasuyoshi Ichikawa | Male | ✓ | ✓ | ✓ | ✓ | |||||

| Morimasa Ikemoto | Male | ✓ | ✓ | ✓ | ✓ | |||||

| Noriko Yoneda | Female | ✓ | ✓ | ✓ | ✓ |

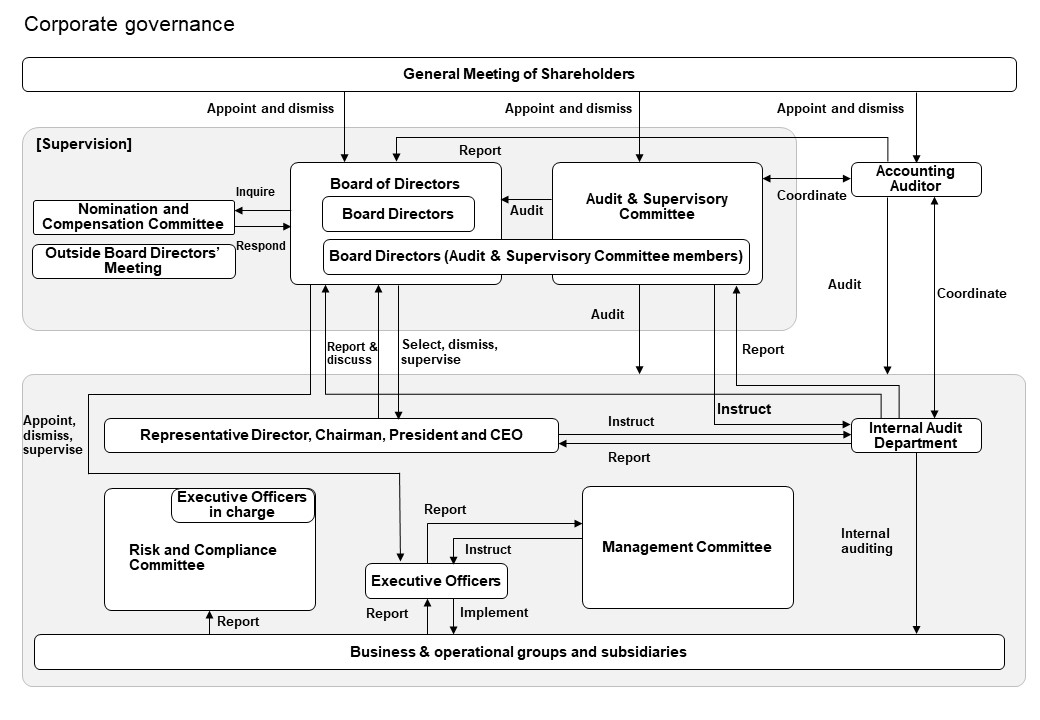

●Corporate Governance Structure

The company's corporate governance structure is as follows.

The Company's Business Execution and Monitoring System

The Company's business execution and monitoring systems are as follows:

(1)Board of Directors

The Board of Directors makes decisions on important matters of business execution stipulated by the Board of Directors regulation and matters required by laws and regulations, while continuously supervises the status of business execution. In addition, the Company employs multiple independent outside directors who are experts in diverse fields to strengthen the supervisory function of business execution and develop an effective system through appropriate advice. In principle, the Board of Directors meets once a month on a regular basis, and extraordinary meetings are held as necessary.

In addition, the Board of Directors delegates part of the authority to execute management to the Management Committee, which is chaired by the CEO and is composed of executive officers who supervise each division, in accordance with the Group Approval Authority and Related Company Management Rules. The Board of Directors consists of 9 members, including 3 internal directors and 6 independent outside directors.

Representative Director, Chairman and CEO : Masahiro Koezuka

Representative Director, President and COO : Hisato Yoshida

Internal Director : Yutaka Yoneyama

Lead Independent Outside Director : Masatoshi Suzuki

Independent Outside Directors : Sachiko Kasano, Kazuhiro Nishihata, Yasuyoshi Ichikawa, Morimasa Ikemoto and Noriko Yoneda

(2)Audit & Supervisory Committee

The Audit & Supervisory Committee conducts audits on the legality and appropriateness of the execution of duties by directors, ensures the soundness of the Company, and acts in the common interest of shareholders with a view to sustainable enhancement of corporate value. One full-time Audit & Supervisory Committee Member is elected to enhance the effectiveness of the audit and supervisory functions by attending important meetings and strengthening cooperation with the Accounting Auditor and Internal Audit Department. An Outside Director chairs the Committee. In principle, the Audit & Supervisory Committee meets once a month, and extraordinary meetings are held as necessary.

The Audit & Supervisory Committee consists of three Directors, of which three are independent outside directors.

Independent Outside Directors : Yasuyoshi Ichikawa (Chairman), Morimasa Ikemoto (Full-time), and Noriko Yoneda

(3)Nomination and Compensation Committee

The Nomination and Compensation Committee, which is composed of members elected from among the directors by resolution of the Board of Directors, is established as a voluntary advisory body to the Board of Directors with the aim of improving transparency regarding election and compensation of directors who are not Audit and Supervisory Committee Members and executive officers, and election of directors who are Audit and Supervisory Committee Members. The Nomination and Compensation Committee is consulted by the Board of Directors and makes recommendations on the election and compensation of directors who are not Audit and Supervisory Committee Members and executive officers, and the election of Directors who are Audit and Supervisory Committee Members. The Committee formulates election criteria and policies for the personnel of directors and executive officers, and policies for the compensation of directors who are not Audit and Supervisory Committee Members and executive officers and deliberates compensation levels. To adopt independent perspectives, an Outside Director chairs the Committee and two-thirds of the Committee members are Independent Outside Directors.

Lead Independent Outside Director : Masatoshi Suzuki (Chairperson)

Independent Outside Directors : Sachiko Kasano and Kazuhiro Nishihata

Representative Director, Chairman and CEO : Masahiro Koezuka

(4)Outside Directors Meeting

The Outside Board of Directors' group meeting is held every month to gather and share information necessary for Independent Outside Directors' management decision-making and to exchange opinions including their ideas and necessity of discussion for the Board of Directors. The meeting is chaired by a Lead Independent Outside Directors. The Outside Directors' Meeting is composed of all independent outside directors, and the representative director participates as necessary.

Lead Independent Outside Director : Masatoshi Suzuki (Chairperson)

Independent Outside Directors : Sachiko Kasano, Kazuhiro Nishihata, Yasuyoshi Ichikawa, Morimasa Ikemoto and Noriko Yoneda

Representative Director, Chairman and CEO : Masahiro Koezuka

(5)Lead Independent Outside Director

Our company selects the Lead Independent Outside Director from among the Independent Outside Directors. The role of the Lead Independent Outside Director is to act as a liaison between the management and the Independent Outside Directors and to facilitate dialogue between them. In addition, the Independent Outside Directors Meeting is convened to determine the agenda of the meeting when necessary, and serves as the chairman of the meeting, and the results of the deliberations are communicated to the management or the Board of Directors to encourage discussion.

Lead Independent Outside Director : Masatoshi Suzuki

(6)Management Committee

The Management Committee deliberates and makes decisions on important matters relating to the execution of the Group's business and on important matters to be submitted to the Board of Directors, as determined by the Board of Directors regarding the transfer of authority. In principle, the Management Committee meets once a week.

The Committee consists of the CEO, executive officers, and organizational heads appointed by the CEO.

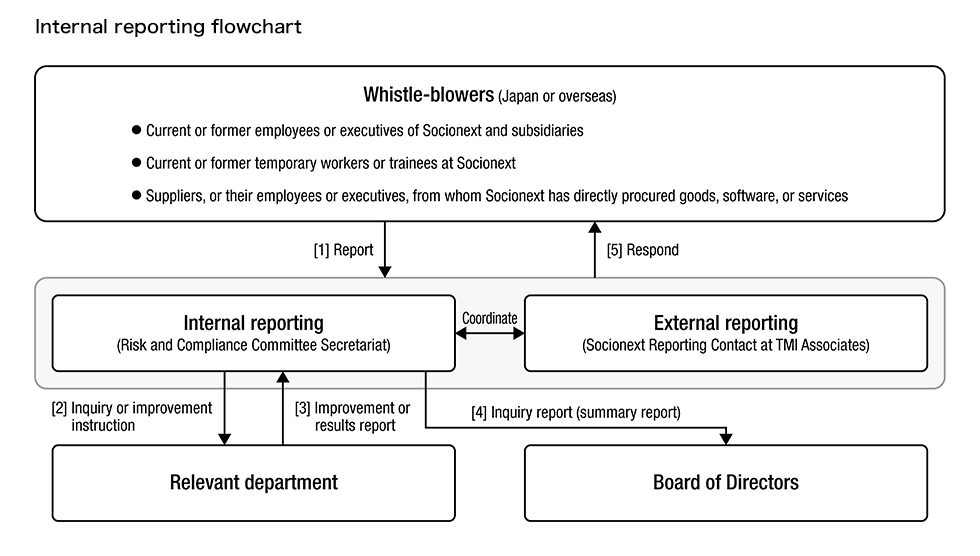

(7)Risk and Compliance Committee

The Risk and Compliance Committee discusses to identify, analyze and take measures for risks including information security, compliance and disasters. Business risks, such as those relating to the business environment, strategy, finance, labor management and supply chain, are deliberated by the Management Committee. The Risk and Compliance Committee meets quarterly.

The Committee consists of the chairperson (CEO), committee members (executive officers) and organizational heads appointed by the CEO.

(8)Internal Audit Department

The Internal Audit Department, which is established directly under the CEO, conducts internal audits on the overall development of internal controls over management activities and the status of execution of business in the Group. The Internal Audit Department's audit plan is approved by the CEO and the Audit & Supervisory Committee, and the results of the Internal Audit Department's audit are reported to the CEO and the Audit & Supervisory Committee. In addition, the Audit & Supervisory Committee can direct the Internal Audit Department as necessary.

Security Export Control

Our group has established a system for security export control and is implementing appropriate operations. In addition to establishing relevant internal regulations at each our group company, we have established a specialized division within the company, the Security Export Control Office, and are working under the following basic policies.

With regard to the export of regulated goods, brokered trade transactions, and technology brokered transactions, no acts contrary to the Foreign Exchange Law and Foreign Law shall be conducted.

In order to comply with foreign exchange and foreign laws and to implement appropriate export control, a person responsible for security export control shall be appointed and an export control system shall be established and enhanced.

Information Security

●Information Security/Protection of Personal Information

Socionext, which operates in the “Solution SoC” business, is actively working on information security as one of key management issues, as it may keep important confidential customer information in its development operations.

Our group ensure information security throughout the Group by establishing basic measures and systems to ensure information security, and by managing information confidentiality, integrity, and availability in a balanced manner, thereby ensuring appropriate handling of information assets of our group, customers, and business partners.

Our group compline to the relevant laws and regulations in each country and manages and protects all personal information, including customers, business partners and employees. our group handles personal information carefully in accordance with the relevant laws and regulations of each country and collects, stores, modifies, transfers, shares and otherwise processes personal information to the extent necessary to achieve its identified purposes of use.

We also provide education on information security and personal information protection through e-learning for all our company employees. Our group has established regulations for information security and protection of personal information to ensure thorough information management, and employees who violate these regulations are subject to disciplinary action in the company's work rules.

Risk Management System for Information Security and Personal Information Protection

The Risk and Compliance Committee discusses identifying, analyzing, and taking measures for information security risks. The Risk Compliance Committee meets quarterly. The Committee consists of the chairperson (Representative Director, Chairman, President, and CEO), committee members (Executive Officers), and organizational heads appointed by the CEO.

About the Privacy Policy

Socionext Inc. ("Socionext") fully acknowledges that it is Socionext's social responsibility as a company to appropriately handle the personal information of each user. With this in mind, Socionext promises to respect the value of personal information and protect all acquired personal information according to the following rules.

(1)Socionext shall periodically educate its board members and employees about the personal information management system. A privacy management chief will be assigned within each department which handles personal information to ensure that personal information is managed appropriately.

(2)Socionext shall use personal information only for the purpose stated beforehand or for the purpose apparent under the circumstances of information acquisition, and only when the user consents in advance or disclosure is required for legal reasons.

(3)Socionext shall not provide personal information to any third party without prior consent from the user, with the exception of disclosures required for legal reasons. Upon providing personal information to a third party, that party is obligated by contract or agreement to handle the personal information appropriately.

(4)Socionext shall employ strict policies to ensure handling of personal information and prevent leakage, loss or damage of personal information, and shall take corrective measures when any breach occurs.

(5)When a user wishes to make an inquiry or wants to raise complaints, or when disclosure of personal information which Socionext has the right to disclose is requested in person (or by a representative), Socionext shall quickly take reasonable action to comply through the appropriate department.

(6)Socionext shall follow the Japanese laws, guidelines and other norms for handling personal information.

Socionext shall continuously improve the personal information management system.

Global Tax Policy

Socionext Group (hereinafter referred to as We) has established in its CSR Policy that it fully complies with laws, regulations, and social norms and responds to the trust of society.

We also clarify its approach to tax-related matters by formulating this global tax policy. The revision of this Policy shall be carried out with the approval of the Board of Directors.

1.Basic policy

We understand the legislative intent of the tax laws enacted by countries in which Socionext and its subsidiaries operate and commit to comply with such laws. Further, we support the OECD's international tax rules and the action plan on Base Erosion and Profit Shifting (BEPS), through which we pay taxes in a timely and appropriate manner and fulfill social responsibilities.

2.Tax Governance

Under the leadership of the Chief Executive Officer (CEO) of the Company, we have established a framework under which the tax governance of the group is supervised and controlled by the CFO and corporate finance division of the Company, with the cooperation of regional management who have responsibility for tax affairs in the overseas subsidiaries. With this framework, we appropriately respond and adapt to the changing global taxation environment, including the latest tax legislation changes, in the countries and regions where we operate and have business relations.

3.Tax risk management

We take the following actions to minimize tax risks:

Our specialized tax organization works closely with the business operations department to discover tax risks in the early stages.

When a material tax risk is identified, we will investigate the facts and determine how to treat such a risk in the context of legislative intent.

If any uncertainty as to the tax processing remains, we will seek the advice of outside specialists or make advance inquiries to the tax authorities as necessary in an effort to eliminate such uncertainty.

In cross-border intra-group transactions, we analyze the functions and risks of overseas subsidiaries and determine the transaction prices in accordance with the OECD's guidelines on transfer pricing and our transfer pricing policy.

4.Approach to tax haven

We don't use tax havens (countries or regions with no tax or extremely low tax rates) with no presence of actual business conditions for the purpose of international tax avoidance.

5.Tax planning

In order to maximize shareholder value, we strive to realize an appropriate tax burden by applying tax incentives using the most favorable method within the scope of our business objectives and legislative intent.

6.Organization and personnel training

As tax-related issues are complex and may have a material impact on cash flows, tax affairs require expertise and wide experience. We take the following actions for the operation of tax-related organizations and the training of personnel:

Since we are required to find solutions for complex tax-related issues and provide instructions for our domestic and overseas subsidiaries, our specialized tax organization will continue to secure and foster experienced personnel with a high level of expertise.

Each subsidiary develops human resources that can smoothly carry out tax operations by collaborating with external experts.

We make efforts to spread the necessary knowledge on tax among all employees.

7.Relationship with Tax Authorities

We aim to maintain a relationship of trust with tax authorities by providing appropriate information and responding sincerely to each country's tax authorities. If a difference of opinion should arise with each country's tax authority, we will communicate constructively with the tax authority to seek a resolution to the issue.